Disney no doubt will give an early update on streaming numbers, likely in December. Analysts already are looking to the 2020 film slate, which will have a brutally tough comparison against a string of 2019 hits. There’s still one more earnings report with no contribution from streaming. The Catalyst Problem for Disney StockĪll told, I’d certainly be cautious with DIS stock, at least from a near-term standpoint. 7, five days before the official streaming launch, that’s not a good thing in terms of near-term trading in DIS. That patience already appears to be waning. The only way that multiple holds is if investors stay patient in terms of the opportunity from Disney+, which will take time to ramp. Combine that pressure with any sort of disappointment from Media Networks, and even the current price could well be in the range of 25x fiscal 2020 (or FY21) EPS. Even the Home Entertainment business, which still generates almost $2 billion in revenue, likely will take a hit.Īs a result, as even CEO Bob Iger has admitted, near-term earnings are going to take a hit. The company has pulled content from the likes of Netflix (NASDAQ: NFLX) and foregone high-margin licensing revenue as a result. But it’s at least possible that investor bullishness toward the launch went too far.Īfter all, Disney+ is going to hit earnings in coming years. And management was optimistic toward the opportunity. The price point - $6.99 - seems logical, admittedly. Yet Disney stock gained over $20 billion in market value in a single day on the news of the launch. On this site, Luke Lango highlighted the service’s potential back in January. Meanwhile, it’s not as if the launch of Disney+ was a surprise. The 11% decline in the last two months, including a post-earnings dip, suggest that investors are starting to remember. The skeptical case toward DIS stock since April has been that investors are too optimistic about Disney+ - and in the process forgetting about challenges elsewhere in the business. Advertising revenue is relatively stable, but only due to more ads. Cord-cutting represented a real risk to the affiliate fees Disney generated from ESPN, ABC, and other smaller networks.Īnd as I noted last month, the third quarter report showed that old worries about the company’s media business persist. The company’s Media Networks segment historically has generated almost half of its profit. The key reason for the sideways trading was concern about the company’s television business, primarily ESPN.

At the time, in 2015, its all-time high was $120. But fundamentally, the argument seems stronger.Īfter all, before that April launch, Disney stock had been range-bound for years.

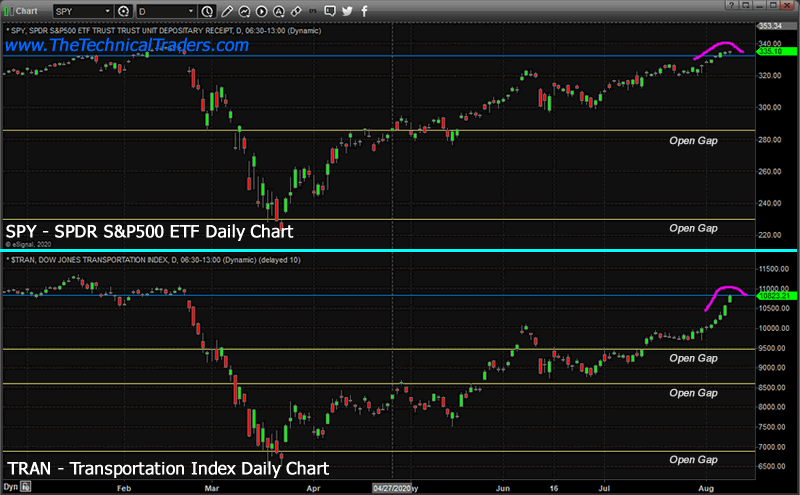

The move, anecdotally, seems more common when stocks gap down - perhaps on an overreaction to news - than up. In the case of DIS stock, filling the gap would suggest a return to the $117 level reached before the April disclosure of details surrounding the Disney+ streaming service. “Filling the gap” is an old - and not always accurate - trading strategy that suggests that a gap in a stock will be filled in either direction.

0 kommentar(er)

0 kommentar(er)